After covering a few more of our client’s stories, we thought it’d be a good idea to see what other publications are doing about the timeshare crisis today. But after inspecting some of the advice that’s possibly directing thousands of vacation owners, we had to step in. You see, not all online information and bias can be completely trusted today. So let’s take a look at how CNBC is trying to help owners exit timeshares.

The Ease of a Timeshare Exit is Not That Easy.

As the news provider kicks off their article, they clearly acknowledge that there is a timeshare problem in 2021. In fact, traveling in general is said to be rather hopeless. “With tourism at a near standstill, making a long-term commitment to an annual vacation spot may have seemed like a better idea before a global pandemic restricted travel and caused a sudden spike in unemployment,” the article says.

Millions of Americans, in general, have been left without any spending money. Sadly, many timeshare owners have been forced to spend extra cash on a vacation package they cannot even use. But according to CNBC, contractual obligations are only the tip of the iceberg. “Some owners, who are often Baby Boomers and considered high-risk for contracting COVID, want out of their units and the financial obligation.”

Why Don’t Timeshare Owners Just Cancel the Purchase?

In reality, escaping a perpetual timeshare burden is extremely difficult. The one thing the article fails to mention is that almost every timeshare purchase is a liability. “While there are different models, most timeshare owners buy either a fraction of real estate at a vacation destination or points they can use at a property,” CNBC says. In fact, there aren’t many cases where the ownership of real estate is actually owned, rather it is a right-to-use agreement to access the property.

While they aren’t completely inaccurate, their choice of words can be misleading. Either way, they do a good job reminding readers of loan interest and how buyers are responsible for maintenance fees for the “lifetime of their contract.” Payoffs, deed transfers and cheap cancellation services don’t always help owners exit timeshares. Oftentimes, these annual fees remain – alongside past due balances.

Ownership Costs Usually More Than Expected.

The publication also presented numbers that explain the failure rates of the product. “For timeshare loans, the overall delinquency rate was 12.8% in 2019 compared to less than 4% for traditional mortgage financing.” This means, 1 out of every 8 buyers fail to cover the affordable vacation. It also correlates with their inability to get out of it.

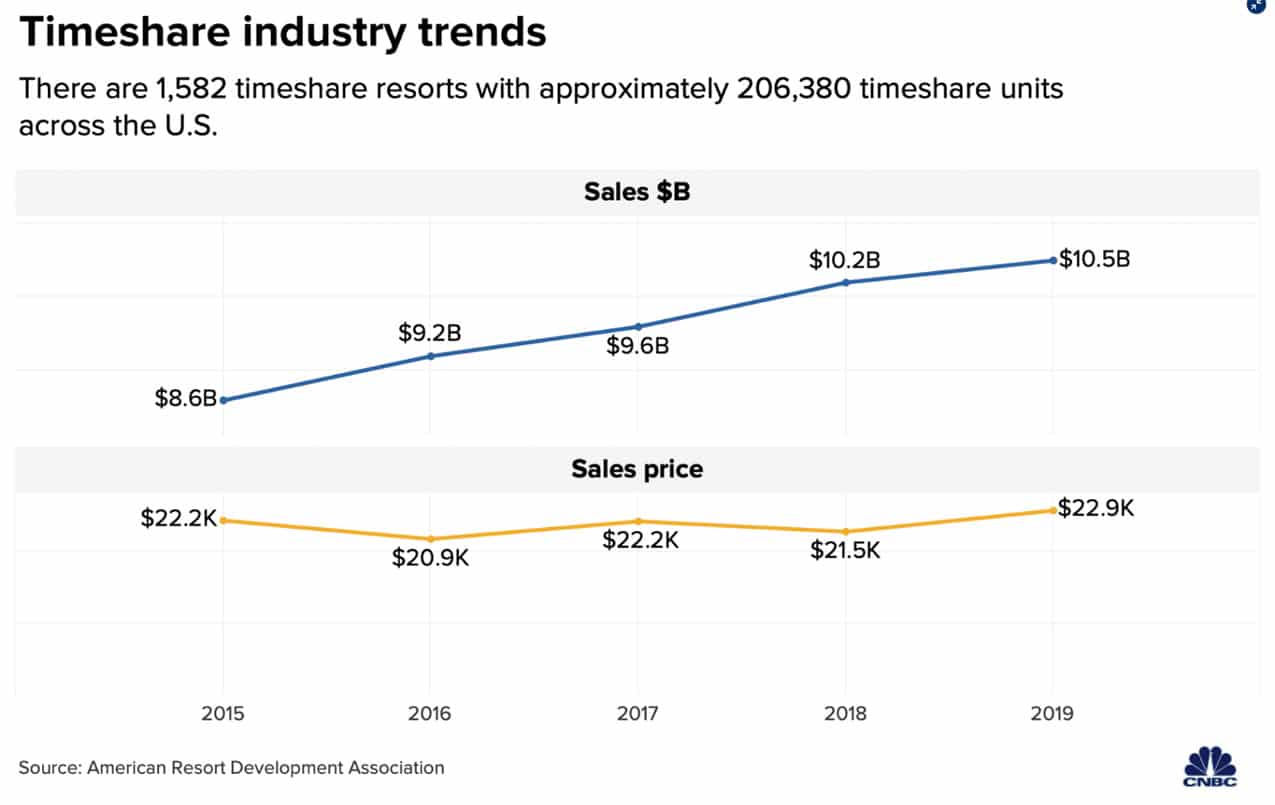

It was also encouraging to see the media outlet break down the overall cost of timeshare ownership from 2019 (above). This isn’t something that’s often explained. “The price of a typical timeshare with a week’s worth of vacation time was $22,942 plus maintenance costs of about $1,000 a year,” they said.

The ARDA graph they shared showed that the sales prices for timeshares have been fairly consistent since 2015. But again, they fail to explain that most have zero resale value. This also suggests they believe the best way to help owners exit timeshares is through resale opportunities. But is this sound advice?

Timeshare Sales Prices Don’t Apply to Owner Resale.

Even if the average sales price (by the resort) climbs a little every year, it doesn’t mean the owner will be able to sell at this price point. Timeshare operations spend millions of dollars on sales strategies. There’s no way an average consumer can compete with the aggressive sales presentation. Many buyers should know this because they now own something they no longer want or need.

CNBC’s analysis of this data is also a tad misleading. “Pre-pandemic, timeshare ownership had been on the rise. In the last five years, sales volume increased 5% a year, on average,” the article reads. But this data may cause some owners to believe they should hold onto the “asset” until the market recovers – as if it were a home mortgage or something.

Article Seems to Praise Resellers & Resorts.

In a way, CNBC makes it appear as though the industry is on the up and up and ownership could be exciting in the near future. “Major resorts and developers, such as Marriott Vacations Worldwide, Disney and Club Wyndham, have also been building more and more units with 865 timeshares added in 2019, up from 588 in 2018. Another 643 units were planned for 2020, according to ARDA,” they say.

But is this worth getting excited over as a vacation owner? Or will the aftermath of the pandemic simply include additional, increased fees for loyal members that can’t make reservations? Instead of expounding on these authentic concerns, CNBC’s goes on about current developments. “Timeshare sales for the new Marriott Vacation Club in Costa Rica are planned to launch in January 2021.”

News Outlet Sheds Light on Timeshare Oblivion.

Despite the agony of some owners across the country, the news outlet appears eager to cover the plans and outlook of major hotel chains. They quote Ed Kinney, the global VP of the Ritz-Carlton, Westin, St. Regis and Sheraton brands saying this: “We are full steam ahead [and have] been really happy with how quickly we’ve been able to respond and the willingness of our guests to return to our properties.” Why promote this with this article topic?

Does it sound like Ed would be interested in helping unhappy owners exit timeshares? Wealthy timeshare conglomerates are glad vacations owners haven’t abandoned them due to the hostage situation they’re in. Whether the writer meant to touch on this or not, the despair of the purchase has been obvious for quite some time now.

The closing paragraph of the introduction reads: “Before the coronavirus crisis, as much as 85% of timeshare owners regretted their purchase.” What makes this statement interesting is that it was a quote from the owner of a prominent timeshare rental platform. Since these types of services tend to eat up the hope and pockets of timeshare owners, it was concerning to see this CEO as an expert resource.

Before They Help Owners Exit Timeshares, CNBC Offers Pandemic ‘Management’ Advice:

At this point in the article, we started to become concerned with the narrative. First and foremost, CNBC tells disgruntled vacation owners that they “may be able to rent” their timeshare “for a year or two” while they’re not using it – “in order to defer payments.”

Not only is this “solution” rarely fruitful, but false pretenses can lead consumers into an array of money-draining rental and resale scams. Even direct resources through the resort have been known to backfire on timeshare owners. Pushing this idea as an efficient way to manage the property is concerning to us. Besides, it doesn’t help owners exit timeshares.

Can Owners Really Use Their Saved Up Points?

From here, the article started offering tips for “post-pandemic vacations.” Meaning, planning for the next time the timeshare is available. “Owners who didn’t use their timeshare in 2020 can bank their points and double up in 2021,” they claim. It’s almost as if they’re trying to spin the loss of a paid vacation as a good thing.

Although optimism is encouraged, you have to be realistic. If a timeshare agreement only allows the owner to reserve one week per year, how are they going to make up for their lost week from 2020? Perhaps by paying more fees with third party exchange platforms that have no guarantees on availability. What happens if owners can’t travel in 2021? Even an upgraded vacation may not be worth the money spent in the meantime.

Are New Travel Costs & Exchanges Viable Solutions?

Another skeptical form of advice provided was to go on a road trip. If readers are specifically looking to escape the burden to save money, how does this help? In other words, why does the content in the article not match its title? They also suggest “exchanging or trading [the week] for a destination within driving distance.” But again, the suggestion isn’t relevant.

What’s the point if owners can’t make a reservation? Besides, an exchange may only return an inferior product in a less than ideal location with additional fees if they have poor trading power. If they claim to know how to help owners exit timeshares, then why would they mention noise that is not related to exiting a timeshare?

Giving Away Deeds & Trusting the Resort for Relief?

From here, the article continued to go down hill, in our opinion. As a last resort, the news outlet recommended “transfering the property to a brother or best friend” as an adequate solution. “One of the biggest selling points of a timeshare is that they can be passed on or gifted to a friend or family member and that’s still the case,” they claim.

This is flat out troublesome to us. Without going into much detail – if you’re unhappy with the product, don’t give it to somebody else. Especially a close relative or loved one. Some owners even try to donate their deed to a charity. But advising someone to do this is concerning.

Do Timeshares Even Provide Hardship Assistance?

The last timeshare management tip CNBC provided is “to seek hardship assistance”. At first glance, the logic behind the idea makes sense. Most creditors have put relief programs in place due to COVID-19 (such as deferring payments). But deferring payments doesn’t help owners exit timeshares altogether. It may only provide temporary relief.

“If you are experiencing severe financial strain due to COVID and cannot cover the costs, reach out to the developer or lender for help. They may work with you to defer payments or reduce the level of ownership to reduce the payment or financial liability,” CNBC claims. While some resorts may offer assistance, owners should be cautious.

Nearly every call to the timeshare can be seen as a sales opportunity. Especially during a time where in-person sales presentations are either closed or limited. As a matter of fact, we’ve heard plenty of stories from owners that have been tricked into new contracts during these conversations. Sadly, empty promises in vulnerable moments lead them to unknowingly commit to larger financial obligations.

Does CNBC Say How To Get Out of Timeshares?

After reading the vague vacation ownership tips above, we were hoping to come across a grand exit strategy that’s feasible for disgruntled buyers. But we never did. According to the news source, “If you want out entirely, the easiest way is to see if your developer or resort operator will take or buy back the timeshare at no cost. Some will even offer maintenance-free usage for a few years in return.”

The article went on to refer readers to a user forum for more information on selling their weekly interval. “You can hire a timeshare resale company to help unload the property for a fee,” it read. Now the purpose of the article came full circle. “For owners who still owe money on their loan, this is one of the few ways to recoup some losses, particularly if the unit is in a desirable vacation destination like Florida,” CNBC claims. But they fail to offer tips on how to list a property effectively as this industry is littered with scams, ultimately costing an owner thousands for failed results in their pursuit to sell a timeshare.

Reasoning for Doubting Vague Publications For Help.

Almost every government agency has publicly warned vacation owners about resale companies and scams in the marketplace – especially those that request upfront fees. The reality is, the secondary market is extremely risky. Promoting hope via dangerous methods is poor advice in our opinion.

For the most part, a transfer of ownership won’t even be considered by a timeshare resort if the private lending mortgage isn’t paid off in full. The fees involved in the transfer itself are also worth mentioning. The process may not be as simple or affordable as they are conveying it to be.

Finding Relief in a Market Full of Devastation.

Truth be told, there are a number of factors that play into getting out of timeshares. Basic guidance like this may only set timeshare owners up for failure. Unfortunately, there are thousands of websites out there that are looking to capture the attention of vulnerable owners filled with desperation. So make sure you take the time to analyze every option and never agree to anything that isn’t in writing.

At VOC, we’ve taken the time to build a reputable business model that consumers can trust. We don’t spend our time and money on extensive, overbearing sales pitches. In fact, we invest a lot of our resources in sharing the stories of victimized timeshare owners to prevent others from becoming victims as well. At the end of the day, better understanding your experience and current situation helps us point you in the right direction.